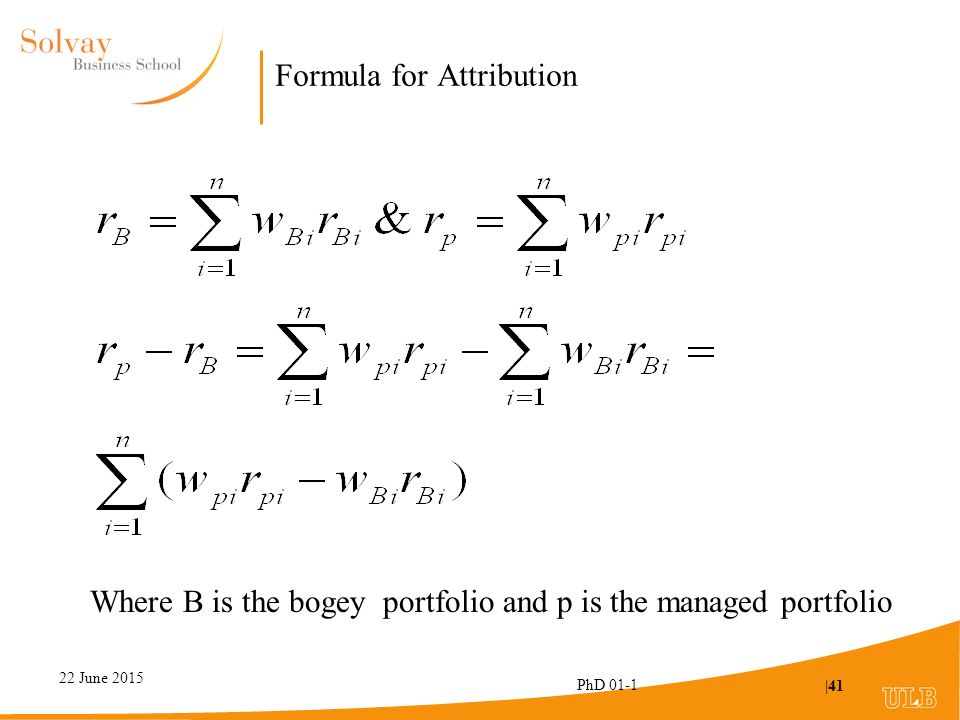

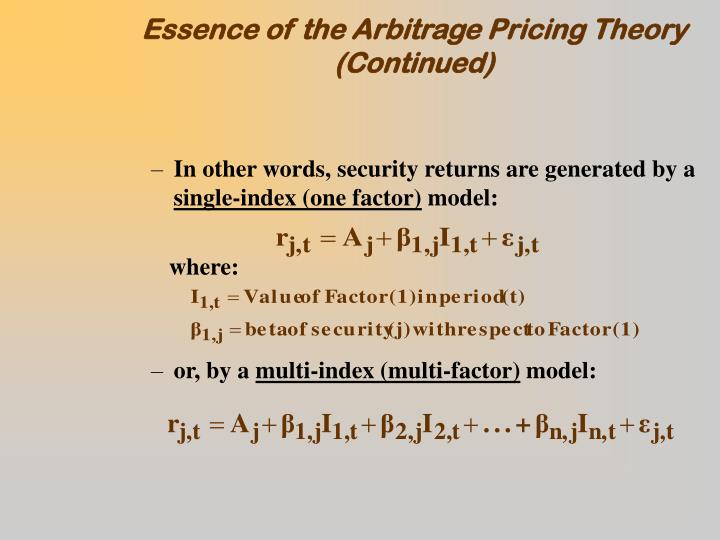

In Asset Pricing and Portfolio Choice Theory, Kerry E. Back at last offers what is at once a welcoming introduction to and a comprehensive overview of asset pricing. Useful as a textbook for graduate students in finance, with extensive exercises and a solutions manual available for professors, the book will also serve as an essential reference. The first part is a whirlwind tour of asset pricing theory. Here, John adopts the traditional organization expected utility, static portfolio choice, static CAPM and APT as equilibrium relations where supply meets demand, and finally we meet the discount factor and consumptionbased pricing. Portfolio Theory Statistics section, view the beta. Introduction: from Assumptions to Implications The Capital Asset Pricing Model (CAPM) 6 V. Portfolio Choice in the CAPM World A. The investors problem is to choose the best portfolio P. The Capital Asset Pricing Model (CAPM)). For one, asset pricing models presume a theory of portfolio choice. Unresolved issues in the asset pricing literature, such as the equity premium puzzle (Mehra. In Asset Pricing and Portfolio Choice Theory, Kerry E. Back at last offers what is at once a welcoming introduction to and a comprehensive overview of asset pricing. Useful as a textbook for graduate students in finance, with extensive exercises and a solutions manual available for professors, the book will also serve as an essential reference for scholars and professional Abstract. We survey the literature that has explored the implications of decisionmaking under ambiguity for financial market outcomes, such as portfolio choice and equilibrium asset prices. Asset Pricing and Portfolio Choice Theory (Financial Management Association Survey and Synthesis Series) read books online for free no download yahoo answers Asset Pricing and Portfolio Choice Theory (Financial Management Association Survey and Synthesis FINS4776 FINS5576 Asset Pricing Theory CRICOS Code G 4. After class lectures, study the lecture material, preferably in groups, and solve the homework problems. Modern portfolio theory (MPT), or meanvariance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of diversification in investing, the idea that owning different kinds of financial assets is less risky than owning only one type. The book illustrates how information choice is used to answer questions in monetary economics, portfolio choice theory, business cycle theory, international finance, asset pricing, and other areas. It shows how to build and test applied theory models with information frictions. In the 2nd edition of Asset Pricing and Portfolio Choice Theory, Kerry E. Back offers a concise yet comprehensive introduction to and overview of asset pricing. Back offers a concise yet comprehensive introduction to and overview of asset pricing. Equilibrium Asset Pricing and Portfolio Choice In period t: Generation t enters the market at the beginning of the period. 142 There is a mass one continuum of competitive agents a [0, 1. Asset Pricing Theory is an advanced textbook for doctoral students and researchers that offers a modern introduction to the theoretical and methodological foundations of competitive asset pricing. Costis Skiadas develops in depth the fundamentals of arbitrage pricing, meanvariance analysis, equilibrium pricing, and optimal consumptionportfolio choice in discrete settings, but with emphasis. KERRY BACKAsset Pricing and Portfolio Choice Theory. Asset Pricing and Portfolio Choice Theory Ebook written by Kerry Back. Read this book using Google Play Books app on your PC, android, iOS devices. Download for offline reading, highlight, bookmark or take notes while you read Asset Pricing and Portfolio Choice Theory. Preface to the First Edition xv Preface to the Second Edition xvi Asset Pricing and Portfolio Puzzles xvii PART ONE SinglePeriod Models 1. Utility and Risk Aversion 3 In finance, the capital asset pricing model (CAPM) is a model used to determine a theoretically appropriate required rate of return of an asset, to make decisions about adding assets to a welldiversified portfolio Kerry Back's textbook on asset pricing elegantly covers two PhD. level courses in asset pricing theory. It contains portfolio choice theory, equilibrium and derivative pricing. TOPICS IN DYNAMIC ASSET PRICING Course Description This course has two main objectives: First, to introduce students to the frontier of Kerry Back Asset Pricing and Portfolio Choice Theory, Oxford University Press, 2010 h) Optimal Consumption and Portfolio Choice: Dynamic Programming and the Martingale Approach TN1. In the 2nd edition of Asset Pricing and Portfolio Choice Theory, Kerry E. Back offers a concise yet comprehensive introduction to and overview of asset pricing. Intended as a textbook for asset pricing theory courses at the Ph. The first two parts of the book explain portfolio choice and asset pricing theory in singleperiod, discretetime, and continuoustime models. For valuation, the focus throughout is on stochastic discount factors and their properties. According to his CV, a 2nd edition of the book is under preparation. Anyone know the changesupdates, that is, what are new topics added and what changes are made. This course aims to provide a comprehensive introduction to the pricing of financial assets. We will cover the main pillars of asset pricing, including choice theory, portfolio theory, ArrowDebreu pricing, arbitrage pricing, and dynamic models. Errata: Asset Pricing and Portfolio Choice Theory Second Edition Kerry Back April 8, 2018 1. 7 needs the additional assumption that c 1 c 0. This risky portfolio held in common by all loss averse investors is defined as the market portfolio. It is shown that a market portfolio will exist in any capital market equilibrium based on a generalized risk measure derived from a singlefactor beta pricing model. The Capital Asset Pricing Model: Theory and Evidence Eugene F. French T he capital asset pricing model (CAPM) of William Sharpe (1964) and John The CAPM builds on the model of portfolio choice developed by Harry Markowitz (1959). In Markowitzs model, an investor selects a portfolio at time asset f and a risky. 12F003 Asset Pricing 6 ECTS Asset Pricing 1 Professor: Javier GilBazo Professor email: Introduction This course is an introduction to the foundations of Asset Pricing. The first two parts of the book explain portfolio choice and asset pricing theory in singleperiod, discretetime, and continuoustime models. For valuation, the focus throughout is on stochastic discount factors and their properties. Can anyone comment on Asset Pricing and Portfolio Choice Theory by Kerry Back as opposed to Asset Pricing by John H. 5 ways to build wealth outside the stock market. If you want to become less dependent on. Using crosssectional data from the SCF and Tax Model, we show that entrepreneurial income risk has a significant influence on portfolio choice and asset prices. The first two parts of the book explain portfolio choice and asset pricing theory in singleperiod, discretetime, and continuoustime models. For valuation, the focus throughout is on stochastic discount factors and their properties. Asset pricing and portfolio choice theory. [K Back In the 2nd edition of Asset Pricing and Portfolio Choice Theory, Kerry E. Back offers a concise yet comprehensive introduction to and overview of asset pricing. Intended as a textbook for asset. This paper shows that the framework proposed by Barberis and Huang (2009) to incorporate narrow framing and loss aversion into dynamic models of portfolio choice and asset pricing can be extended to also account for probability weighting and for a value function that is convex on losses and concave on gains. In the 2nd edition of Asset Pricing and Portfolio Choice Theory, Kerry E. Back offers a concise yet comprehensive introduction to and overview of asset pricing. Intended as a textbook for asset pricing theory courses at the Ph. Most of the theory of asset pricing is about how to go from marginal utilityto observable indicators. Consumption is low when optimal consumption and portfolio choice, ptu (c t) Et u (c t1)xt1 (1. 1) or pt Et ConsumptionBased Model and Overview. If you are looking for the ebook Asset Pricing and Portfolio Choice Theory (Financial Management Association Survey and Synthesis) by Kerry Back in pdf form, then you've come to the loyal site. In Asset Pricing and Portfolio Choice Theory, Kerry E. Back at last offers what is at once a welcoming introduction to and a comprehensive overview of Asset pricing. Useful as a textbook for graduate students in finance, with extensive exercises and a solutions manual available for professors, the book will also serve as an essential reference for scholars and professionals, as it includes. The theory of financial markets under homogeneous information has generated a rich body ofpredictions, extensively used in the financial industry, such as the optimality of indexing, therestrictions imposed by absence of arbitrage, and equilibriumbased pricing relations. Asset Pricing and Portfolio Choice Theory. [K Back In Asset Pricing and Portfolio Choice Theory, Kerry E. Back at last offers what is at once a welcoming introduction to and a comprehensive overview of asset pricing. Useful as a textbook for graduate. In Asset Pricing and Portfolio Choice Theory, Kerry E. Back at last offers what is at once a welcoming introduction to and a comprehensive overview of asset pricing. Back at last offers what is at once a welcoming introduction to and a comprehensive overview of asset pricing. the classical theory of asset price determination and portfolio selection. In the second half of the semester, we consider extensions of these basic models in a variety of new directions. In Asset Pricing and Portfolio Choice Theory, Kerry E. Back at last offers what is at once a welcoming introduction to and a comprehensive overview of asset pricing. Useful as a textbook for graduate students in finance, with extensive exercises and a solutions manual available for professors, the book will also serve as an essential reference for scholars and professionals, as it includes. We can also view this problem as an alternative approach to the asset pricing question. So far, we have modeled the consumption process, and then found prices from marginal I start by developing portfolio theory by the choice of nal (mx) framework of the rest of the book. It contains portfolio choice theory, equilibrium and derivative pricing in both discrete and continuous time models. Back never loses focus on developing intuition drawing analogies between discrete time and continuous time models while keeping the coverage rigorous and complete. Dynamic Asset Pricing Suleyman Basak Aims and Objectives. The objective of this course is to provide the participants with the necessary skills to dynamically value In this module, we build on the insights obtained from modern portfolio theory to understand how risk and return are related in equilibrium. We first look at the main workhorse model in finance, the Capital Asset Pricing Model and discuss the expected returnbeta relationship..