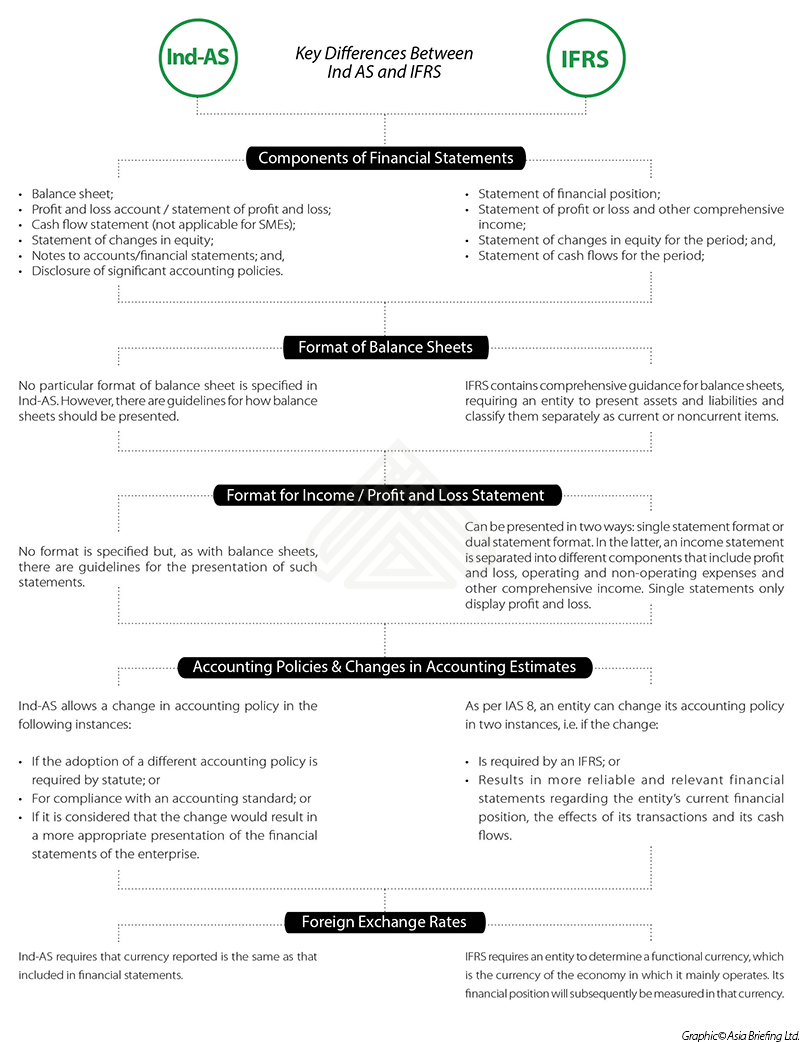

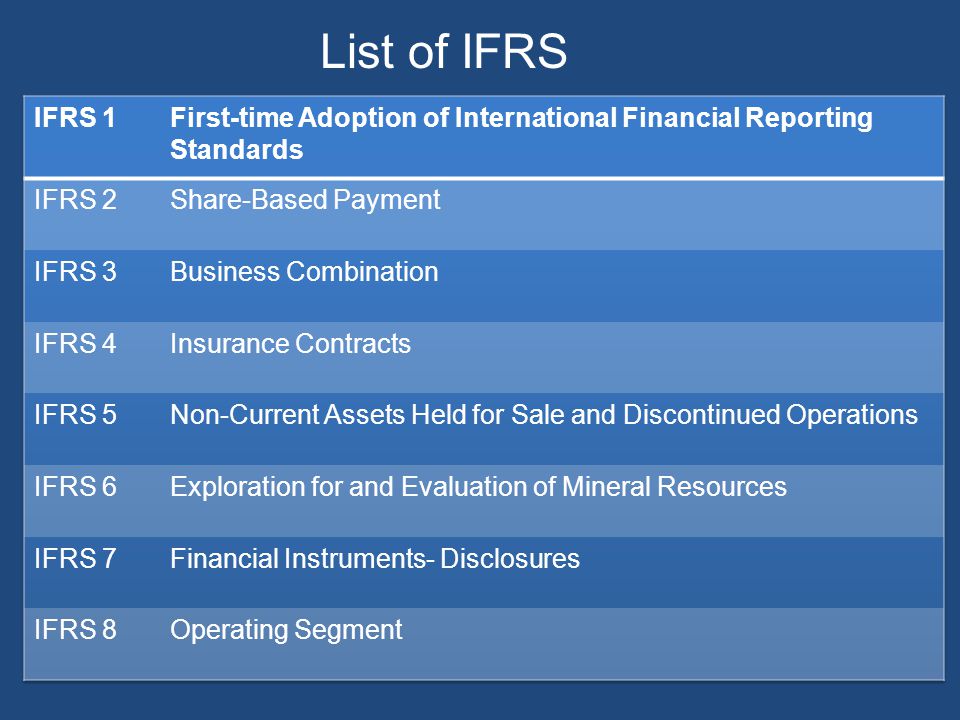

Conclusions, and the Preface to International Public Sector Accounting Standards. IPSAS 3, Accounting Policies, Changes in Accounting Estimates and Errors, provides a basis for selecting and applying accounting policies in the absence of The estimated amount of time this product will be on the market is based on a number of factors, including faculty input to instructional design and the prior revision cycle and updates to academic researchwhich typically results in a revision cycle ranging from every two to four years for this. IASB Accounting regulation and enforcement Unusual Featurers Financial statements may be in Dutch, French, German, or English Other than consolidated financial statements of Dutch listed companies, financial statements may be based on Dutch guidelines, IFRS, or a combination. The International Accounting Standards Board (IASB) is the independent, accounting standardsetting body of the IFRS Foundation. The IASB was founded on April 1, 2001, as the successor to the International Accounting Standards Committee (IASC). Studying International Finance Accounting (IFA) at Saxion has been, by far, the best decision I have made in my career. The programme is packed with finance, which is exactly the basis that I needed to advance in the field of investments. The Journal of International Accounting Research publishes articles that increase our understanding of the development and use of international accounting and. A basic introduction to the content of the International Accounting Course. International Accounting Bulletin is the only global magazine covering the professional services world. Focusing on business issues affecting firms, networks and associations, it is a trusted source for leading accounting news, as well as vital data and analysis provided by its survey features. The 2018 World Congress of Accountants is the premier accounting conference for the global business and finance community. Held every four years, WCOA 2018 will bring more than 6, 000 delegates from 130 countries together in Australias stunning world city of Sydney. Deakin's Master of International Accounting (MIA) provides graduates of any discipline with the opportunity to undertake studies towards gaining membership of the Association of Chartered Certified Accountants (ACCA). An ACCA accounting qualification is. International Financial Reporting Standards, usually called IFRS, are standards issued by the IFRS Foundation and the International Accounting Standards Board (IASB) to provide a common global language for business affairs so that company accounts are understandable and comparable across international boundaries. International Accounting is designed for advanced students of accounting and financial statement analysis at undergraduate, MBA and specialist postgraduate level. The major second edition of International Accounting reflects the rapid move towards international standards over the last five years. Learn international accounting with free interactive flashcards. Choose from 500 different sets of international accounting flashcards on Quizlet. Bookkeeping and international accounting. International support every step of the way As a growing business looking to expand your operations overseas, improve visibility of your international operations or manage the cost of doing business worldwide, BDO can help. International Financial Reporting Standards (IFRSs) are Standards and Interpretations adopted by the International Accounting Standards Board (IASB). In this post, we will be discussing about all things related to certified public accounts. Be it a burgeoning startup or a nonprofit organization or a multinational corporation, CPAs are. The International Accounting Standards Committee (IASC) is a private sector body whose membership includes all the professional accountancy bodies that are members of the International Federation of Accountants (IFAC). International Accounting: A User Perspective is designed to provide an understanding of international accounting issues to current and future business managers. With the problems exposed in the quality of financial reporting in many countries, a solid understanding of international accounting issues is an important part of the portfolio of. The Economist offers authoritative insight and opinion on international news, politics, business, finance, science, technology and the connections between them. The Fourth Edition of International Accounting provides an overview of the broadly defined area of international accounting, but also focuses on the accounting issues related to international business activities and foreign operations. The International Accounting Education Standards Board establishes standards, in the area of professional accounting education, that prescribe technical competence and professional skills, values, ethics, and attitudes. The aims of The International Journal of Accounting are to advance the academic and professional understanding of accounting theory and practice from an international perspective and viewpoint. The journal recognizes that international accounting is influenced by a variety of forces i. governmental, political and economical. Graduates of the Master of International Accounting course would typically seek employment in areas of accounting such as financial accounting, auditing, taxation, management accounting, public sector accounting, forensic accounting, or business advisory services. The International Accounting Education Standards Board establishes standards, in the area of professional accounting education, that prescribe technical competence and professional skills, values, ethics, and attitudes. About the Author Lee Radebaugh, Ph. , is the Director of the School of Accountancy and Information Systems and KPMG Professor of Accounting at Brigham Young University. In addition, he is the Executive Director of the BYU Center for International Business Education and Research (CIBER). The International Auditing and Assurance Standards Board is an independent standardsetting body that serves the public interest by setting highquality international standards for auditing, assurance, and other related areas, and by facilitating their adoption and implementation. Top Courses in International Accounting A course is the study of a particular topic within a wider subject area and is the foundation of a qualification. A typical course includes lectures, assessments and. The Journal of International Accounting, Auditing and Taxation publishes articles which deal with most areas of international accounting including auditing, taxation and management accounting. The journal's goal is to bridge the gap between academic researchers and practitioners by publishing papers that Advances in International Accounting. German Reporting Practices: An Analysis of Reconciliations from German Commercial Code to IFRS or US GAAP. Latin American Banking Institutions Trading on NewYork Stock Exchange: of Latin American Accounting Standards and US GAAP. The IFRS Foundation's logo and the IFRS for SMEs logo, the IASB logo, the Hexagon Device, eIFRS, IAS, IASB, IFRIC, IFRS, IFRS for SMEs, IFRS Foundation, International Accounting Standards, International Financial Reporting Standards, NIIF and SIC are registered trade marks of the IFRS Foundation, further details of which are available from the IFRS. The IFRS Foundation's logo and the IFRS for SMEs logo, the IASB logo, the Hexagon Device, eIFRS, IAS, IASB, IFRIC, IFRS, IFRS for SMEs, IFRS Foundation, International Accounting Standards, International Financial Reporting Standards, NIIF and SIC are registered trade marks of the IFRS Foundation, further details of which are available from the IFRS. The Master of Accounting and Audit program at Bang College of Business, KIMEP University is designed to prepare highquality Accounting and Auditing professionals capable of solving complex business problems in todays global markets. Find International Accounting Textbooks at up to 90 off. Plus get free shipping on qualifying orders 25. Choose from used and new textbooks or get instant access with eTextbooks and digital materials. International accounting standards Regulation (EC) No Law details Information about Regulation (EC) No including date of entry into force and links to. International Accounting Standards are an older set of standards which were replaced by International Financial Reporting Standards (IFRS) in 2001. The International Accounting Education Standards Board establishes standards, in the area of professional accounting education, that prescribe technical competence and professional skills, values, ethics, and attitudes. General overview of factors that affect international accounting, how companies experiece international trade, and the global economy. (International Account Sample of firms that adopted International Accounting Standards (IAS) between 1994 and 2003 (IAS firms) and matched sample of firms that did not (NIAS firms). The period before IAS firms adopt IAS, that is, the preadoption period, begins in 1990. The period after IAS firms adopt IAS, that is, the postadoption period, ends in 2003. International Accounting is a rapidly expanding field and its importance has grown in tandem with our globalising world. In addition to technical skills, employers expect recruits to understand the context of accounting information within wider social, political, economic, natural and cultural environments. This book includes a wide range of topics that deals with international accounting standards, regulations, and financial reporting. The book is a timely collection of several original research papers written by wellknown authors and experts in the field from countries around the globe on very important and emerging issues in international accounting. Today's top 625 International Accountant jobs in United States. Leverage your professional network, and get hired. New International Accountant jobs added daily. Our international accounting masters degree program introduces you to the management of international financial systems, foreign exchange rates, and foreign exchange risk and exposure. Understand the daily fluctuations of the global monetary system. international accounting can be viewed in terms of the standards. international accounting can be viewed as the study of the standards. and taxation that exist within each country as well as comparison of those items across countries. and (3) the requirements for becoming a member of the. International Public Sector Accounting Standards (IPSASs) as the standards to be applied by members of the profession in the preparation of general purpose financial reports of public sector entities. International accounting is a specialty within the entire discipline that is focused on using specific accounting standards that are as relevant in the US as they are when you are balancing the books of a company overseas. 45 rowsInternational Accounting Standards (IASs) were issued by the antecedent International Accounting Standards Council (IASC), and endorsed and amended by the International Accounting Standards Board (IASB). The IASB will also reissue standards in. The International Accounting Standards Board (IASB) is an independent, privatesector body that develops and approves International Financial Reporting Standards (IFRSs). The IASB operates under the oversight of the IFRS Foundation. An International Accounting Association that Enhances Independent Accounting Firms. As an established international accounting association we connect independent accounting firms with businesses looking for top notch professional services..